Helping clients create the financial future they desire requires more than just selecting the right investments. With the growing push to “democratize” alternative investments, investors are increasingly attracted to these products. However, an often-overlooked aspect is the profound impact that fees can have on overall performance. Successfully investing in alternative assets requires careful consideration of both the managers you select and the fees they impose.

…an often-overlooked aspect is the profound impact that fees can have on overall performance.

Manager Selection and The Reality of Fees

With alternatives, the instinct may be to gravitate toward familiar names. After all, no one ever lost their job investing in the same household names as everyone else, right? But is safety in numbers really what’s best for your clients?

In our view, recognizable names offer a false sense of security. The real value you bring to your clients lies in finding managers who deliver alpha while also keeping fees under control. If you can help your clients navigate the complexities of fee structures and steer them towards better value, not only will more ‘net net’ end up in investment returns for them, but you’ll also build trust.

In our view, recognizable names offer a false sense of security. The real value you bring to your clients lies in finding managers who deliver alpha while also keeping fees under control.

The True Cost of Fees

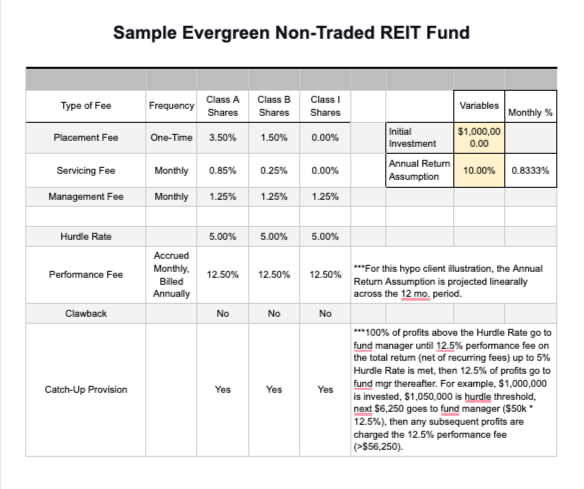

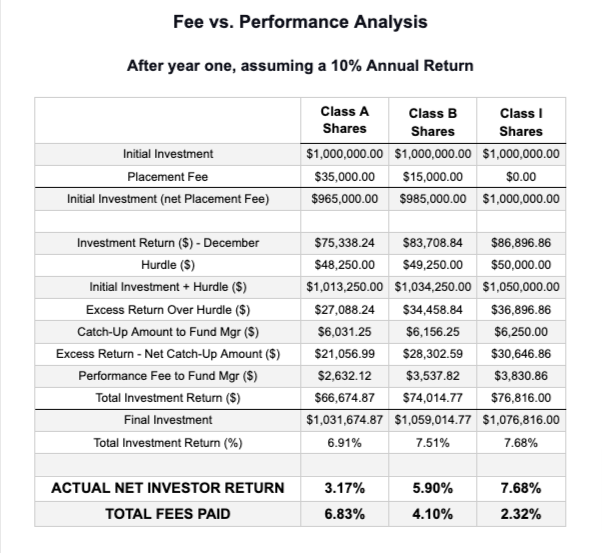

We’ve become too accustomed to a laundry list of fees as the price of entry into alternatives. Yet, as the examples we provide below demonstrate, the cumulative effects of these fees can be staggering. Let’s break down how a $1,000,000 investment plays out across three common share classes in a hypothetical Evergreen Non-Traded REIT.

Note: These are not for a specific fund but are representative of the types of fees you typically find with these types of funds. Share classes and fees vary.

It’s pretty clear. For Class A investors, the fees devour a significant portion of their year-one returns—especially that placement fee, yeesh! Class B is a slightly more favorable structure for fee-based accounts, yet even here, fees eat away at an investor’s bottom line in an alarming way. The Institutional share class offers a look into the rosy institutional outcomes the industry likes to use to market their funds to your clients, but investors typically never see in reality, unless you’re an advisor of scale and can negotiate access to institutional share classes.

The Institutional share class offers a look into the rosy institutional outcomes the industry likes to use to market their funds to your clients, but investors typically never see this in reality, unless you’re an advisor of scale and can negotiate access to institutional share classes.

The Real Trade-Off: Investors vs. Fees

Even if you’re lucky enough to select a manager who regularly delivers strong performance (and let’s face it, there are only so many so-called ‘top-tier’ managers), the reality is that fees are a huge drag on returns. In most cases, low-fee investment options deliver better net results over time. While alternative investments can provide benefits (e.g., diversification, downside protection, etc.), it’s essential to model whether the potential rewards truly outweigh the costs before investing.

Even if you’re lucky enough to select a manager who regularly delivers strong performance (and let’s face it, there are only so many so-called ‘top-tier’ managers), the reality is that fees are a huge drag on returns.

Our Role in Understanding and Communicating Fees

As financial advisors, it’s our responsibility to break down these complexities for our clients. Many investors who are piling into alternative investments today remain unaware of just how much these costs will impact their portfolios. And, unfortunately, most won’t even realize it until much later down the road, e.g., private equity and other illiquid asset classes with long-term investment horizons.

And, unfortunately, most won’t even realize it until much later down the road, e.g., private equity and other illiquid asset classes with long-term investment horizons.

Conclusion: We Need to Hold Ourselves to a Higher Standard for Fees and Fee Disclosure

The alternative investment industry seems bent on selling your clients the dream of ‘Institutional Models’ without diving deeper into the fact that the ‘Institutional Results’ they like to point to in marketing materials also enjoyed the benefit of ‘Institutional Pricing.’

As trusted advisors, our duty is to protect clients from unnecessary fees and ensure they’re receiving real value for the ones they do pay. If we remain vigilant about the cost of investing, we can better serve our clients and distinguish ourselves as trusted stewards of their wealth.

Contact us to learn how we can help you evaluate managers and fund fees to navigate the alternative investment industry successfully.

Disclaimer:

This article is for informational and educational purposes only and should not be construed as providing investment, tax, or legal advice. It does not take into account the specific investment objectives, financial situation, or particular needs of any reader. Readers should consult with their own tax, legal, and financial advisors to determine the appropriateness of any investment strategy or approach mentioned herein. Investing involves risk, including the possible loss of principal.

PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.