Reality Check

Call us old-fashioned if you want, but in our view, every movie isn’t Oscar-worthy, every kid doesn’t deserve a gold medal just for participating, and every fund manager isn’t ‘best-in-class’—sorry. While we appreciate their optimism, just making the claim in marketing materials doesn’t make it so.

Like we’ve discussed in a previous article, a lot more than performance goes into making a ‘best-in-class’ fund manager. But let’s be real: performance is the conversation starter—or stopper, depending.

Mind the Dispersion

We didn’t plan to jump up on our performance soap box, but here we are. We’ll try and make it quick and informative, promise.

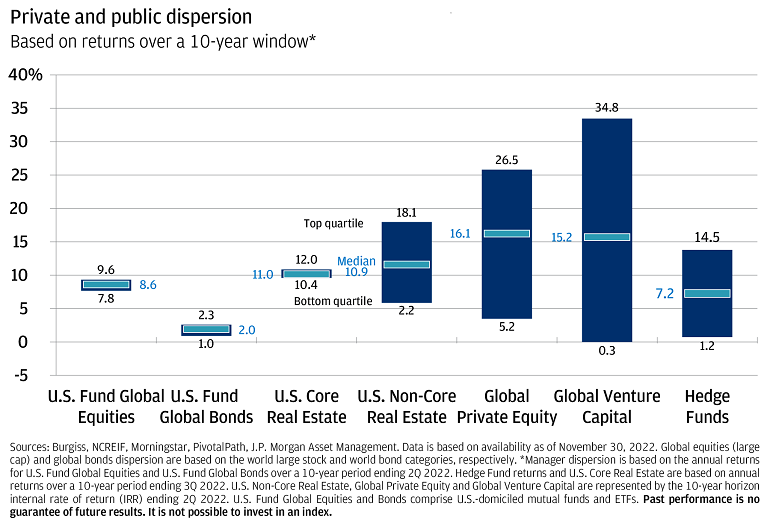

Check out the chart below from JPM and focus on the big blue bars (the private funds and hedge funds).1 According to JPM, the private markets now include more than 18,000 private investment funds and 9,000-plus hedge funds. The big blue bars indicate that the difference between the top-performing and bottom-performing private funds is huge.

What does this mean?

On a performance basis, most managers are not in the top quartile, i.e., there is a high probability of selecting underperforming funds out of the ~27,000 private market offerings. And, although, this will have to be a topic for a future article, we don’t think many people would disagree that these big blue bars are actually bottom-heavy.

On a performance basis, most managers are not in the top quartile, i.e., there is a high probability of selecting underperforming funds out of the ~27,000 private market offerings.

Selecting and getting access to high-quality investments and fund managers is the most critical factor in successfully investing in alternative investments—and it’s hard—no matter what the salesperson or platform may be telling you about their ‘best-in-class’ offerings of ‘top-tier’ managers.

Avoid Performance Sellers

Another thing we’ve been noticing more and more in recent years is a plethora of new fund managers and alternative investment platforms out here employing stereotypical used-car sales tactics to foist whatever ‘best-in-class’ alternative investment clunker they’re trying to ‘get off their lot’ and into your unsuspecting client’s portfolio.

Under the guise of democratization, sales teams with Glengarry Glen Ross-inspired leaders target individual investors with rose-colored performance expectations and high-pressure FOMO techniques instead of focusing on clear and honest educational approaches. This is a disservice to our entire industry.

Under the guise of democratization, sales teams with Glengarry Glen Ross-inspired leaders target individual investors with rose-colored performance expectations and high-pressure FOMO techniques instead of focusing on clear and honest educational approaches. This is a disservice to our entire industry.

Hey, platforms using offer countdown timers and other questionable approaches during fundraising, we’re talking to you. Did you consider educating potential investors in 2022 about what typically happens to real estate when interest rates rise, for example?

See Through the Jargon

We get it. It’s tricky for investment marketers. There are only so many adjectives, and compliance teams typically hate most of the good ones.

For those of us who’ve been around the block a few times, marketing claims of ‘best-in-class’ and ‘top-tier’ don’t really register. We might read through them or may even be guilty of using these descriptors from time to time—something we plan to correct when we give our materials their next review. But we do know that genuine top performers are rare, finding them is resource intensive, and getting access to them can be challenging, if not impossible, for most investors—and even then, there is no guarantee of success.

…genuine top performers are rare, finding them is resource intensive, and getting access to them can be challenging, if not impossible, for most investors—and even then, there is no guarantee of success.

We forget that, for many investors and advisors, alternative investments are new. You’re just trying to figure all this stuff out while, as best as possible, avoiding learning the hard way—by losing your own, or worse, your clients’ hard-earned wealth.

Find a Partner

And here’s where we do our sales pitch. We hope this article has been informative and entertaining. We joke around a lot, but that doesn’t mean we aren’t serious about what we do—we are, and alternative investments are all that we do.

Figuring out how to select the right managers and funds is not easy and finding a partner you can trust to help you is a challenge. You don’t need a salesperson—you need a guide. A guide who’s just as invested in your clients’ success as you are and who can cut through the jargon and help you uncover true, ‘best-in-class’ investment offerings for them.

You don’t need a salesperson—you need a guide. A guide who’s just as invested in your clients’ success as you are…

We’re not just here to throw rocks and have a laugh at the industry’s expense. Let’s talk about how we can help you and your clients navigate the alternative investment industry and improve your chances of success.

Disclaimer:

This article is for informational and educational purposes only and should not be construed as providing tax or legal advice. It does not take into account the specific investment objectives, financial situation, or particular needs of any reader. Readers should consult with their own tax, legal, and financial advisors to determine the appropriateness of any investment strategy or approach mentioned herein.