The Alternative to Traditional Private Equity Funds.

Third Wire / Morningstar PitchBook US Buyout Replication Index Fund (the “Fund”)1 invests directly on a 1:1 basis in the constituents of the Morningstar PitchBook US Buyout Replication Index (the “Index”).

The Index is designed to capture the key characteristics of buyout investing by tracking publicly traded small- and mid-cap stocks that resemble companies in private equity buyout funds. It employs an AI-based, systematic approach, combining top-down industry exposure aligned with the U.S. buyout market and bottom-up company selection using dynamic public market data to identify mature businesses with established cash flows and tangible assets.

The index is the exclusive property of Morningstar, Inc., which does not sponsor, endorse, or promote this fund.

Why replicate PE Buyout?

Private equity managers often attribute their success—and justify their fees—to “operational alpha,” claiming that strategic improvements at their portfolio companies are what drives fund returns. But what if that’s no longer the case for the majority of PE Funds? Recent research by Senior Quantitative Research Analyst at PitchBook Data, Inc. Andrew Akers, CFA revealed that for most buyout managers today, gains primarily stem from just a few factors: leverage, favorable market conditions, and valuation shifts—not the transformational operational changes so often touted.

This research challenges the common narrative that traditional private equity funds offer investors unique value beyond traditional investments. If returns are primarily driven by leverage and market forces—factors that can be replicated with listed equities—it raises critical questions about the premium fees and illiquidity investors are expected to endure for access to most private equity funds.

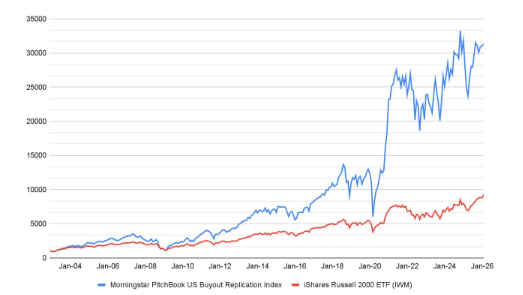

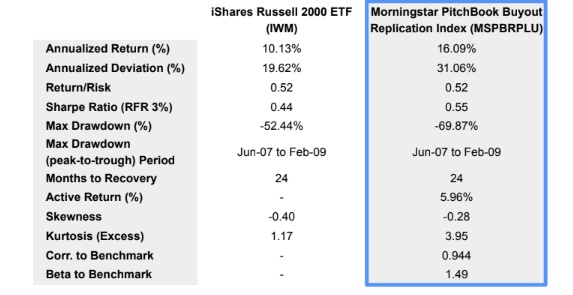

Morningstar PitchBook US Buyout Replication Index Performance

Index Performance Comparison – Jan’ 2003 to Jan’ 2026

Index Performance Summary – Jan’ 2003 to Jan’ 2026

Source: Morningstar. Data as of January 31, 2026

High Risk — High Return Strategy: The Index replicates the asymmetric risk/return profile of private equity buyout strategies, offering a transparent view of the higher potential returns—and the inherent risks—that define private markets. Unlike traditional private equity funds, it reveals the short-term volatility that drives long-term growth, aligning investor expectations with the realities of this asset class.

Volatility is a Feature, Not a Bug: Valuation practices in private equity often obscure volatility, creating the illusion of stability. The Index reflects the inherent short-term fluctuations of small- and mid-cap equities, providing a transparent, daily view of the risks that underpin private equity funds. This transparency helps investors better assess and align their portfolios with long-term goals.

A Purpose-Built Benchmark: The future of private markets investing demands clear and relevant benchmarks, something that hasn’t existed until now. The Index addresses the opacity and benchmarking gaps in private equity by offering an objective, systematic tool for evaluating buyout strategies. It helps investors size allocations appropriately while understanding the risks and opportunities inherent in private equity exposure.

A Fund to Reimagine Private Equity Investing

Third Wire / Morningstar PitchBook US Buyout Replication Index Fund (USBRIF)

Private Equity Buyout Performance with Public Market Liquidity:

The Fund seeks to provide exposure to a portfolio of Index constituents designed to reflect the risk/return profile of private equity buyout funds—while offering enhanced transparency, greater liquidity, and a simplified fee structure compared to traditional private equity funds.

AI-Driven Innovation:

Powered by an advanced LSTM (Long Short-Term Memory) neural network, the Index seeks to identify public companies with take-private characteristics, such as strong free cash flows and stable margins, while maintaining sector and leverage profiles of private equity funds.

Transparent, Flexible, and Cost-Effective:

With lower fees, no performance-based compensation, and no lock-ups, the Fund provides a clear and accessible alternative to traditional private equity funds. This Fund also avoids the J-Curve effect commonly seen in private equity funds.

Structured with Investors in Mind

Third Wire USBRIF

- Redemptions: Monthly

- Lock-Up: None

- Gate: None

- Management Fee: 1.5%

- Performance Fee: None

- Min. Investment: $1M

- Valuations: Daily

- Method: Marked-to-Market

Traditional PE Funds

- Redemptions: None

- Lock-Up: 10-15 Years

- Gate: None

- Management Fee: 1.5% – 2.5%

- Performance Fee: 20% of carried interest

- Min. Investment: $10M – $25M

- Valuations: Periodically

- Method: Marked-to-Imagination

Evergreen PE Funds

- Redemptions: Limited

- Lock-Up: None

- Gate: 5% quarterly

- Management Fee: 1.5% – 2.5%

- Performance Fee: 15%-20%

- Min. Investment: $25K – $100K

- Valuations: Periodically

- Method: Marked-to-Imagination

This Fund is being offered pursuant to Rule 506(c) of Regulation D. Any offer to invest is made exclusively through the Fund’s private placement memorandum or other authorized offering documents and is available only to verified accredited investors. Verification of accredited investor status is required prior to any investment.

Resources

Education

Frequently Asked Questions

Q: What is the objective of the Third Wire / Morningstar PitchBook US Buyout Replication Index Fund (USBRIF)

A: The fund aims to replicate the risk/return profile of private equity buyout strategies by investing 1:1 in a portfolio of publicly traded equities that mirror the Morningstar PitchBook US Buyout Replication Index constituents.

Q: How does the Fund achieve its replication strategy?

A: The fund directly replicates the equal-weighted constituents of the Morningstar PitchBook US Buyout Replication Index on a 1:1 basis. It does not use derivatives or sampling approximations.

Q: What are the potential advantages of this Fund versus traditional Private Equity Funds?

A:

Liquidity: Offers monthly subscriptions and redemptions without a lock-up period.

Transparency: Investments are made in publicly traded equities and priced daily.

Cost Efficiency: Management fees are 1.50%, with no performance fees, catch-up provisions, etc., and no J-Curve effect like traditional Private Equity Funds.

Q: Who is the Fund designed for?

A: The fund is intended for accredited investors and institutions seeking exposure to the Morningstar PitchBook US Buyout Replication Index which was designed to capture the key characteristics of private equity buyout investing by tracking publicly traded small- and mid-cap stocks that resemble companies in private equity buyout funds.

The Fund seeks to provide exposure to a portfolio of Index constituents designed to reflect the risk/return profile of private equity buyout funds—while offering enhanced transparency, greater liquidity, and a simplified fee structure compared to traditional private equity funds.

Q: How is leverage applied to the fund?

A: The fund employs a target leverage ratio of 1.2x to 1.6x, consistent with the index’s methodology. This is achieved at a lower cost compared to private equity, with leverage costs passed directly to investors.

Q: What is the underlying index used for replication?

A: The Fund tracks the Morningstar PitchBook US Buyout Replication Index, which identifies small and mid-cap publicly traded companies with characteristics similar to private equity buyout targets. The index is maintained using a systematic methodology and semiannual reconstitution.

Q: How does the Fund manage trading and liquidity?

A: The Fund rebalances semi-annually to maintain equal weighting and conducts quarterly trading to align with the index turnover. Subscriptions and redemptions are processed monthly, with a 2% holdback on redemptions until the annual audit is complete.

Q: What are the Fund’s fees?

A: The Fund charges a 1.50% management fee. There are no performance fees, redemption fees, or other hidden costs. There are also standard fund expenses that are charged to the Fund.

Q: What are the risks associated with the Fund?

A: Investing in the Fund involves significant risks, including, but not limited to:

- Tracking Error: The Fund’s ability to closely replicate the Morningstar PitchBook Buyout Replication Index may be impacted by factors such as transaction costs, market conditions, and timing differences in index rebalancing. Tracking error could result in returns that deviate from those of the index.

- Market Risk: The Fund’s performance is subject to general market fluctuations and economic conditions that may adversely impact the value of its holdings.

- Volatility: The Fund invests in small- and mid-cap publicly traded equities, which may experience higher price volatility compared to larger, more established companies.

- Liquidity Risk: While the Fund provides monthly redemptions, the underlying securities may experience periods of reduced liquidity, potentially affecting pricing and trade execution.

- Leverage Risk: The Fund employs leverage to enhance returns, which can amplify both gains and losses. The costs and risks associated with leverage are borne directly by investors.

- Private Fund Risks: As with any private fund, there is no guarantee of achieving the targeted investment objectives, and an investor may lose some or all of their investment.

This summary is not exhaustive. Prospective investors should carefully review the Fund’s private placement memorandum or other legal offering documents, which contain detailed information about the Fund’s objectives, fees, risks, and terms of investment. Consulting with a financial advisor, legal counsel, or tax professional is strongly recommended before making an investment decision.

110 North Wacker Drive, Ste 2500, Chicago, IL 60606 I info@thirdwiream.com

©2026 Third Wire Asset Management, LLC. All Rights Reserved.

Important Disclosures

1. The Morningstar Indexes are the exclusive property of Morningstar, Inc. Morningstar, Inc., its affiliates and subsidiaries, its direct and indirect information providers, and any other third party involved in, or related to, compiling, computing, or creating any Morningstar Index (collectively, “Morningstar Parties”) do not guarantee the accuracy, completeness, and/or timeliness of the Morningstar Indexes or any data included therein and shall have no liability for any errors, omissions, or interruptions therein. None of the Morningstar Parties make any representation or warranty, express or implied, as to the results to be obtained from the use of the Morningstar Indexes or any data included therein.

The Fund seeks to replicate certain characteristics of private equity buyout strategies but may not achieve the same results. Past performance is not indicative of future results. Investments are subject to risk, including loss of principal. Investments in public equities may involve significant risks, including market volatility, economic uncertainty, and potential deviations from the Fund’s intended strategy. There is no guarantee that the Fund will achieve its investment objectives.

The Fund is a private offering and is not registered under the Investment Company Act of 1940 or the Securities Act of 1933. As such, it is not subject to the same regulatory requirements as registered investment vehicles. Fees and expenses associated with the Fund may impact overall performance. Investors should review the private placement memorandum for a detailed description of fees and costs.

This document is for informational purposes only and may be shared with the general public under Rule 506(c). Any offer to invest is made exclusively through the Fund’s private placement memorandum or other authorized offering documents and is available only to verified accredited investors. Verification of accredited investor status is required prior to any investment. The Fund is offered pursuant to Rule 506(c) of Regulation D, allowing for general solicitation; however, investment is limited to verified accredited investors.

The Index uses advanced AI methodologies, including Long Short-Term Memory (LSTM) neural networks, to guide security selection and leverage adjustments. The effectiveness of these methodologies is not guaranteed and may be impacted by unforeseen factors or market conditions.

This document may contain forward-looking statements regarding the Fund’s strategy or expected performance. These statements are subject to risks and uncertainties that could cause actual results to differ materially.