Category: Insights

-

Industry Perspective: Beating Back the Bullsh!t.

Originally published on LinkedIn on July 8, 2024 Institutional Investing for Individuals: A Recipe for Disaster (And Why You Should Avoid It) Ok, I just couldn’t read another article or watch another video about how “your clients are more like institutional investors than you think” without speaking up on it.…

-

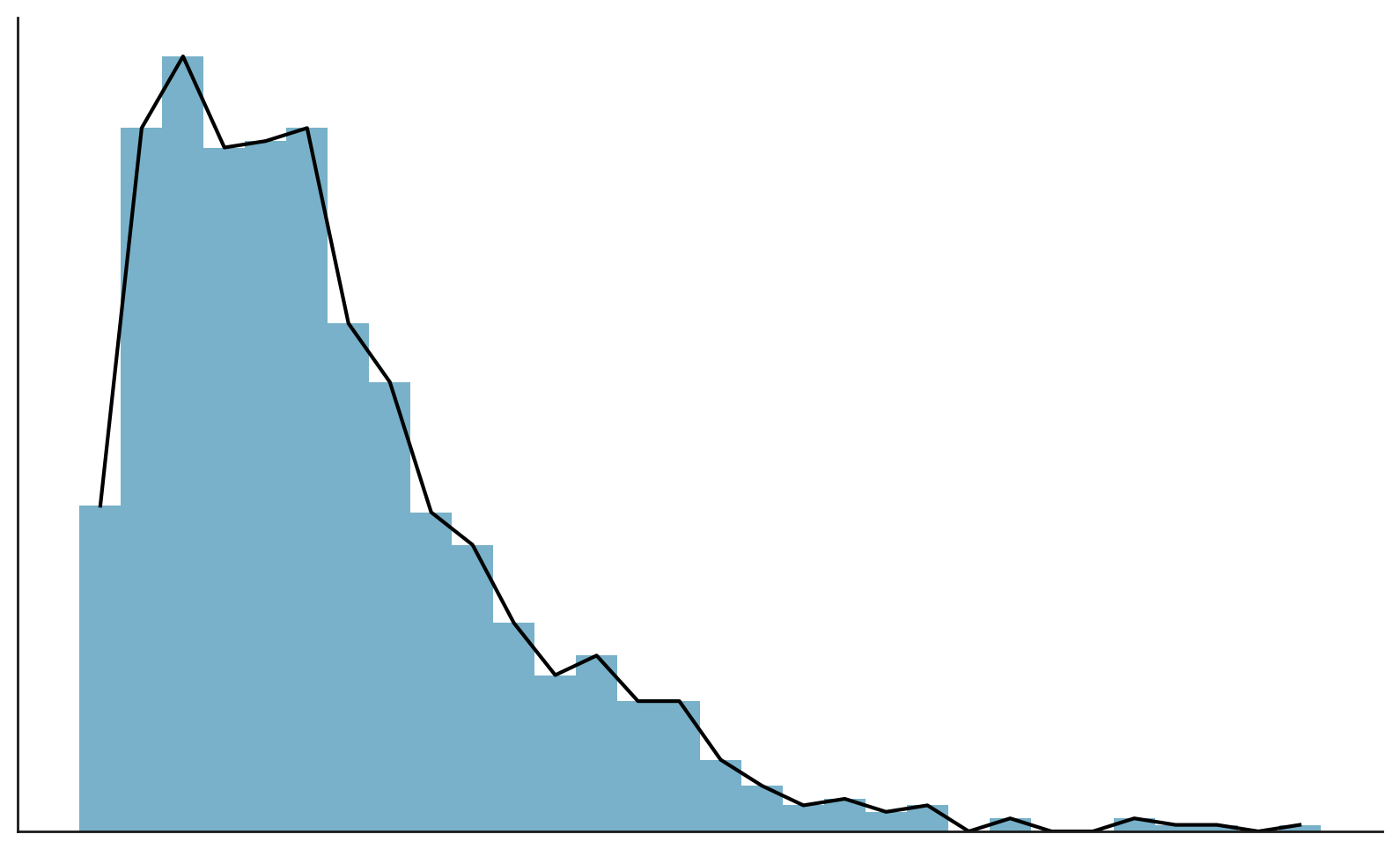

Asset Allocation 201: Sortino Ratio, Positive Skew, and Near-Zero Correlation to Public Markets.

While Sharpe Ratio and standard deviation are cornerstone alternative investment risk metrics and provide valuable insights, other, more nuanced metrics are essential to deepening one’s understanding of an investment’s risk/return potential. In this article we discuss why the Sortino Ratio, maintaining a positive skew, and focusing on keeping a near-zero…

-

Industry Perspective: Aggregation of Aggravation

Originally published on LinkedIn on May 9, 2024 Okay, people. Are you getting as confused as I am by all the “private markets punditry” over the last month or so? Let me see if I can keep this all straight… On the one hand, we’ve got firms with a clear agenda and…

-

Asset Allocation 101: Getting your equity allocation “right”

What’s in a name? The question of how to categorize private equity and whether it belongs to the realm of “alternative investments” might strike some as ‘stupid’ but it isn’t just a matter of semantics. It’s actually pretty important. This isn’t just about labels; it’s about accurately assessing and managing…