Category: Asset Allocation

-

Asset Allocation 201: Synthetic vs. Strategy Replication

In the early 2000s, several firms attempted to synthetically replicate hedge fund indices using statistical modeling and liquid ETFs. The problem? They reverse-engineered the risk/return profile but not the underlying investment strategy. The results looked good on paper—until the global financial crisis hit. When markets turned, these models failed to…

-

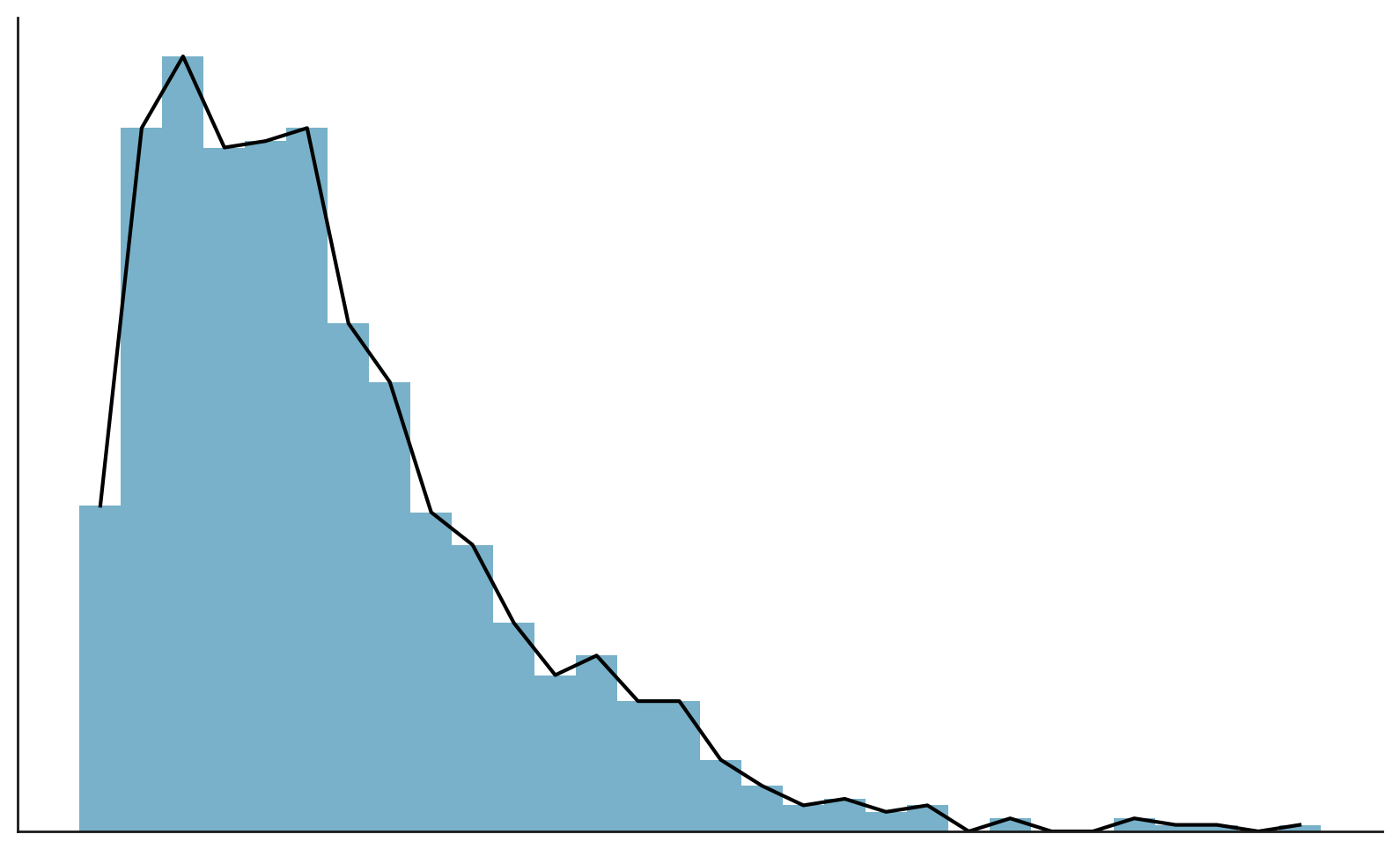

Asset Allocation 201: Fees—The Silent Performance Killer

Helping clients create the financial future they desire requires more than just selecting the right investments. With the growing push to “democratize” alternative investments, investors are increasingly attracted to these products. However, an often-overlooked aspect is the profound impact that fees can have on overall performance. Successfully investing in alternative…

-

Asset Allocation 201: Sortino Ratio, Positive Skew, and Near-Zero Correlation to Public Markets.

While Sharpe Ratio and standard deviation are cornerstone alternative investment risk metrics and provide valuable insights, other, more nuanced metrics are essential to deepening one’s understanding of an investment’s risk/return potential. In this article we discuss why the Sortino Ratio, maintaining a positive skew, and focusing on keeping a near-zero…

-

Asset Allocation 101: Getting your equity allocation “right”

What’s in a name? The question of how to categorize private equity and whether it belongs to the realm of “alternative investments” might strike some as ‘stupid’ but it isn’t just a matter of semantics. It’s actually pretty important. This isn’t just about labels; it’s about accurately assessing and managing…

-

Asset Allocation 101: The ‘Ivy League’ Model isn’t a Fit for Individuals

Remembering our Core Principles Let’s just get this out of the way. Yes, we believe most of your clients could benefit from an allocation to alternative investments. No, we don’t think many of the new entrants in this industry take your clients’ best interests into account when they pitch you…