Category: 201

-

Due Diligence 201: Why Some Evergreen Funds Charge You Fees on Borrowed Money.

It’s a classic scene from Goodfellas. Henry Hill explains how the mob squeezes every penny from a business until it collapses. “They buy your truck, but somehow you’re still paying for the gas.” Well, welcome to the world of evergreen fund fees. One of the most overlooked costs in alternative…

-

Asset Allocation 201: Synthetic vs. Strategy Replication

In the early 2000s, several firms attempted to synthetically replicate hedge fund indices using statistical modeling and liquid ETFs. The problem? They reverse-engineered the risk/return profile but not the underlying investment strategy. The results looked good on paper—until the global financial crisis hit. When markets turned, these models failed to…

-

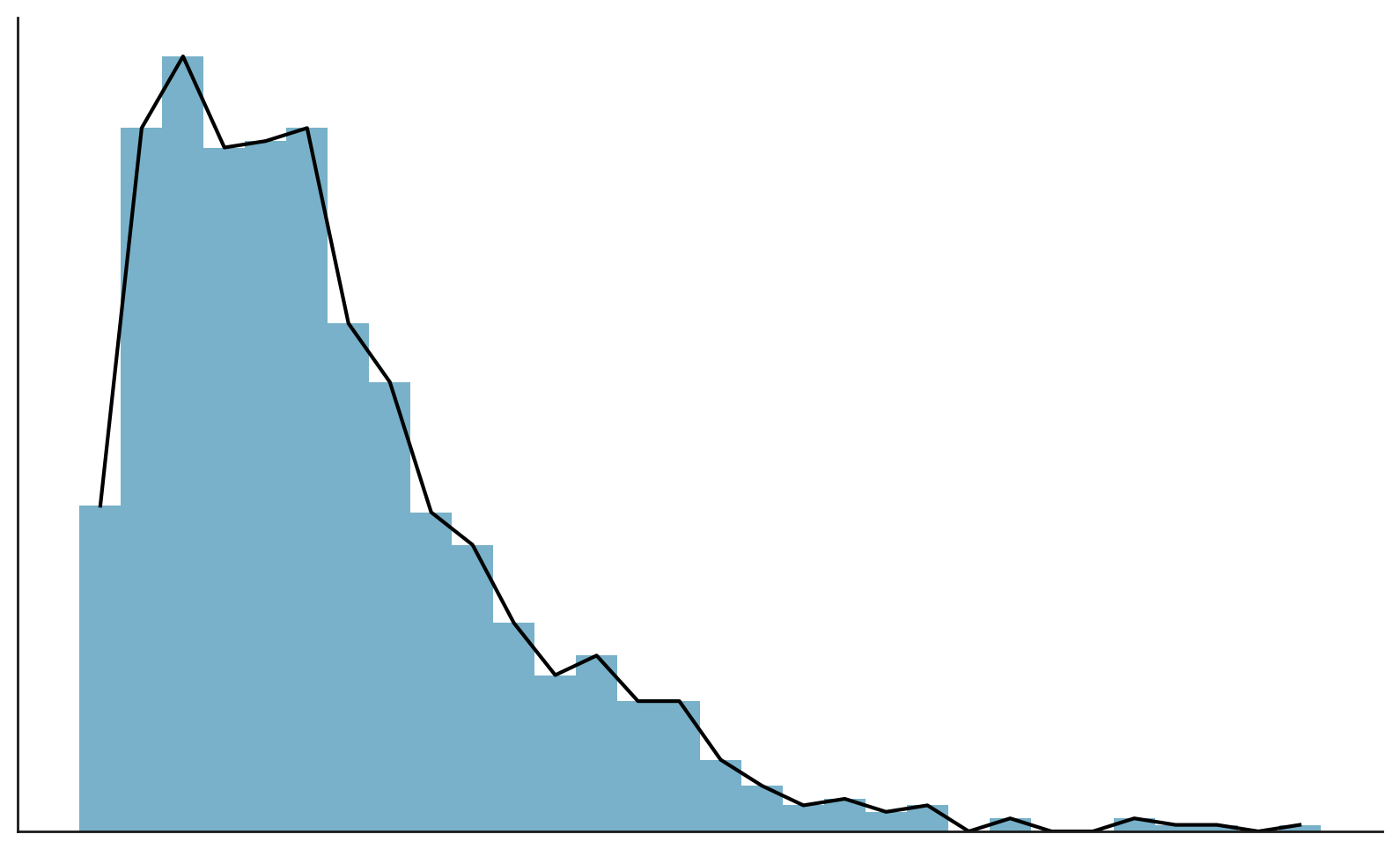

Asset Allocation 201: Fees—The Silent Performance Killer

Helping clients create the financial future they desire requires more than just selecting the right investments. With the growing push to “democratize” alternative investments, investors are increasingly attracted to these products. However, an often-overlooked aspect is the profound impact that fees can have on overall performance. Successfully investing in alternative…

-

Asset Allocation 201: Sortino Ratio, Positive Skew, and Near-Zero Correlation to Public Markets.

While Sharpe Ratio and standard deviation are cornerstone alternative investment risk metrics and provide valuable insights, other, more nuanced metrics are essential to deepening one’s understanding of an investment’s risk/return potential. In this article we discuss why the Sortino Ratio, maintaining a positive skew, and focusing on keeping a near-zero…