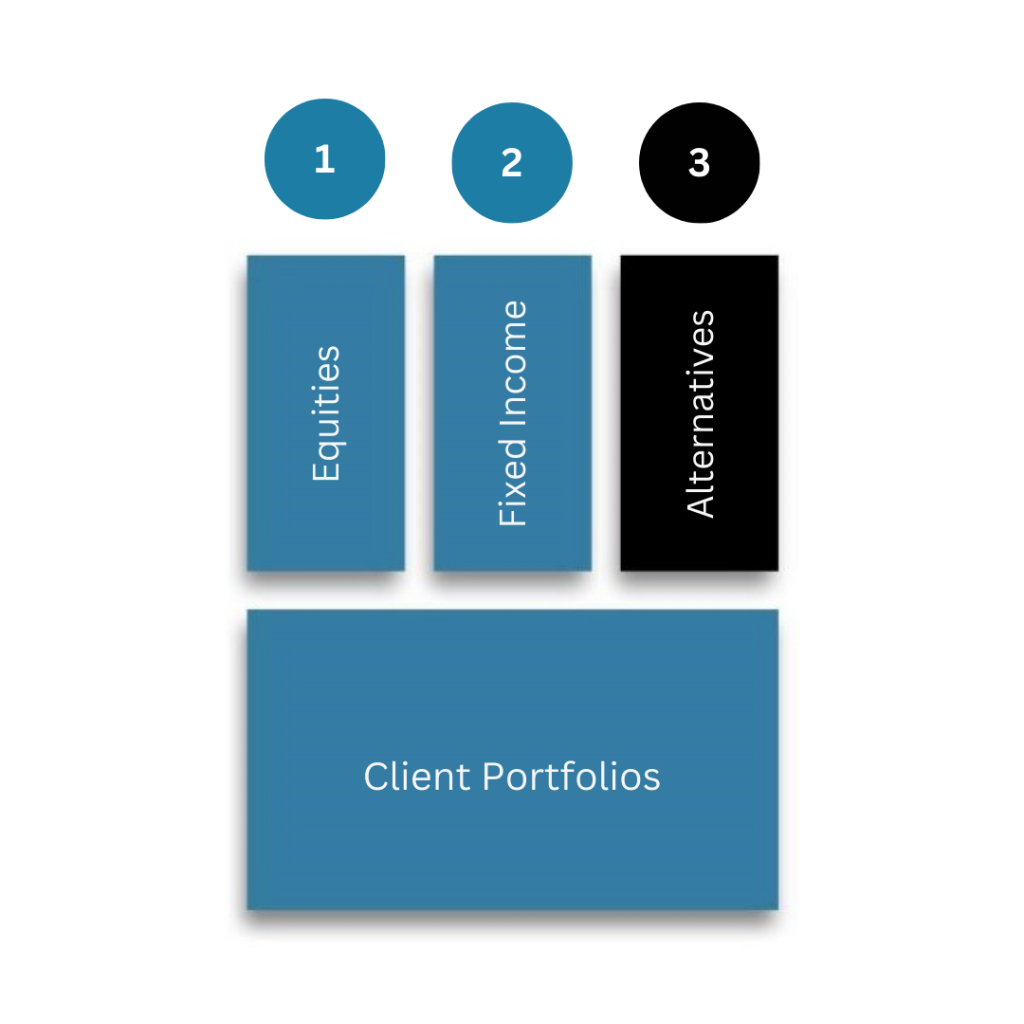

What is the Third Wire?

Imagine traditional client portfolios are like an elevator held by two wires.

Equities

Fixed Income

If wire one falters, wire two is supposed to be there to prevent a free fall. It’s the core concept of diversification.

In recent times, stocks and bonds have displayed a worrying trend of frequently moving in sync, and there are increasing instances when both wires fail simultaneously.

We help you install a Third Wire.

Alternative Investments

This third wire is meant to add long-term diversification and smooths overall portfolio volatility, as well as serving as a vital safety net, helping to slow a portfolio’s descent when the other two wires fail.

The Third Wire Difference

Our team thinks about alternative investments differently. We’re not asset gatherers, and we’re not focused on maximizing the fees that are charged to investors. Along with our award-winning2 partners, we’re here to help you navigate alternatives successfully.

1. Aligned incentives: We are aligned and incentivized in the exact same way as you—advisory fee only. That way, more ‘net net’ ends up in investment returns.

2. Rigorous due diligence: We stand behind every manager we select and conduct rigorous due diligence on all of them. No pay-to-play managers here, and no outsourced due diligence.

3. Clear fees and expenses: No hidden transaction costs, placement fees, performance fees, or redemption fees—none of it.

4. Available: Our hands-on, client-first culture ensures you receive the support you need when you need it.

The Third Wire difference can actually be measured.

Key Partners & Service Providers

Leveraging expert partners and service providers to deliver institutional-grade alternative investment products and services.

Partners

Service Providers

Morningstar Indexes1 was built to keep up with the evolving needs of investors—and to be a leading-edge advocate for them. Our rich heritage as a transparent, investor-focused leader in data and research uniquely equips us to support individuals, institutions, wealth managers and advisors in navigating investment opportunities across major asset classes, styles and strategies. From traditional benchmarks and unique IP-driven indexes, to index design, calculation and distribution services, our solutions span an investment landscape as diverse as investors themselves.

Please visit indexes.morningstar.com for more information.

The Third Wire / Morningstar PitchBook US Buyout Replication Index Fund is a private investment vehicle based on the Morningstar PitchBook US Buyout Replication Index. The index is the exclusive property of Morningstar, Inc., which does not sponsor, endorse, or promote this fund.

About Hydra Platform by Kettera Strategies

The award-winning2 Hydra Platform is an independent investment platform operated by Kettera Strategies, LLC and its team of experienced CIOs, portfolio managers, and researchers.

Our partnership with Kettera gives you access to their highly curated selection fund managers, as well as their research and thought leadership. Kettera’s team of professionals conducts rigorous due diligence on each manager before they are approved for investment through Hydra and also continuously monitors funds while on the platform.

Kettera is fiercely independent and managed by a team of industry veterans who, like us, understand the importance of always putting client needs first and ensuring your interests are aligned with theirs.

Contact Us to learn more about the Hydra Platform by Kettera.

Hydra Platform Awards

The Hydra Platform by Kettera Strategies has been named “Best Managed Account Platform” by the With Intelligence/HFM US Services Awards, for four consecutive years.

110 North Wacker Drive, Ste 2500, Chicago, IL 60606 I info@thirdwiream.com

©2026 Third Wire Asset Management, LLC. All Rights Reserved.

Important Disclosures

1. The Morningstar Indexes are the exclusive property of Morningstar, Inc. Morningstar, Inc., its affiliates and subsidiaries, its direct and indirect information providers, and any other third party involved in, or related to, compiling, computing, or creating any Morningstar Index (collectively, “Morningstar Parties”) do not guarantee the accuracy, completeness, and/or timeliness of the Morningstar Indexes or any data included therein and shall have no liability for any errors, omissions, or interruptions therein. None of the Morningstar Parties make any representation or warranty, express or implied, as to the results to be obtained from the use of the Morningstar Indexes or any data included therein.

The Fund seeks to replicate certain characteristics of private equity buyout strategies but may not achieve the same results. Past performance is not indicative of future results. Investments are subject to risk, including loss of principal. Investments in public equities may involve significant risks, including market volatility, economic uncertainty, and potential deviations from the Fund’s intended strategy. There is no guarantee that the Fund will achieve its investment objectives.

The Fund is a private offering and is not registered under the Investment Company Act of 1940 or the Securities Act of 1933. As such, it is not subject to the same regulatory requirements as registered investment vehicles. Fees and expenses associated with the Fund may impact overall performance. Investors should review the private placement memorandum for a detailed description of fees and costs.

This document is for informational purposes only and may be shared with the general public under Rule 506(c). Any offer to invest is made exclusively through the Fund’s private placement memorandum or other authorized offering documents and is available only to verified accredited investors. Verification of accredited investor status is required prior to any investment. The Fund is offered pursuant to Rule 506(c) of Regulation D, allowing for general solicitation; however, investment is limited to verified accredited investors.

The Index uses advanced AI methodologies, including Long Short-Term Memory (LSTM) neural networks, to guide security selection and leverage adjustments. The effectiveness of these methodologies is not guaranteed and may be impacted by unforeseen factors or market conditions.

This document may contain forward-looking statements regarding the Fund’s strategy or expected performance. These statements are subject to risks and uncertainties that could cause actual results to differ materially.

2. Awards Disclosure: HFM US Service Awards: Rewarding excellence in US hedge fund services recognizes and rewards hedge fund service providers who have demonstrated exceptional client service, innovative product development and strong and sustainable business growth over the past 12 months. The rigorous judging process, based on the views of a panel of leading hedge fund COOs, CFOs, CCOs, GCs and CTOs, ensures that the Awards recognize those driving up service standards across the sector and stand out from the crowd as the ones the big providers really want to win.