Executive Summary:

The investment landscape continues to undergo a significant transformation, with alternative investments moving from the periphery to the central theme of discussions around portfolio construction and diversification. This shift marks a fundamental change in how many firms believe your clients should approach risk, return, and diversification in modern portfolios.

…with this evolution comes a set of challenges that are often understated or overlooked in the industry’s push to ‘Democratize’ alternative investments (their word, not ours).

However, with this evolution comes a set of challenges that are often understated or overlooked in the industry’s push to ‘Democratize’ alternative investments (their word, not ours). These include but are not limited to:

- The increasing number of questionable investment products being created in all corners of the industry and targeted at your clients;

- The misguided push to apply institutional models to individual investors;

- The persistence of outdated fee structures and terms that don’t put the interests of investors first;

- Marketing and sales-driven research and PR masquerading as ‘Educational’ content.

We aim to provide a balanced and critical examination of the alternative investment landscape. Our goal is to cut through the marketing hype and provide practical insights. We’ll examine both the potential benefits and the very real risks associated with alternative investments to deepen your understanding of the industry and help you make more informed decisions with your clients.

By the end, you should have a more nuanced view of when alternatives might be a fit for your clients’ portfolios—and, equally importantly, an idea of when they might not be.

Contact us with questions or to receive a pdf of this paper.

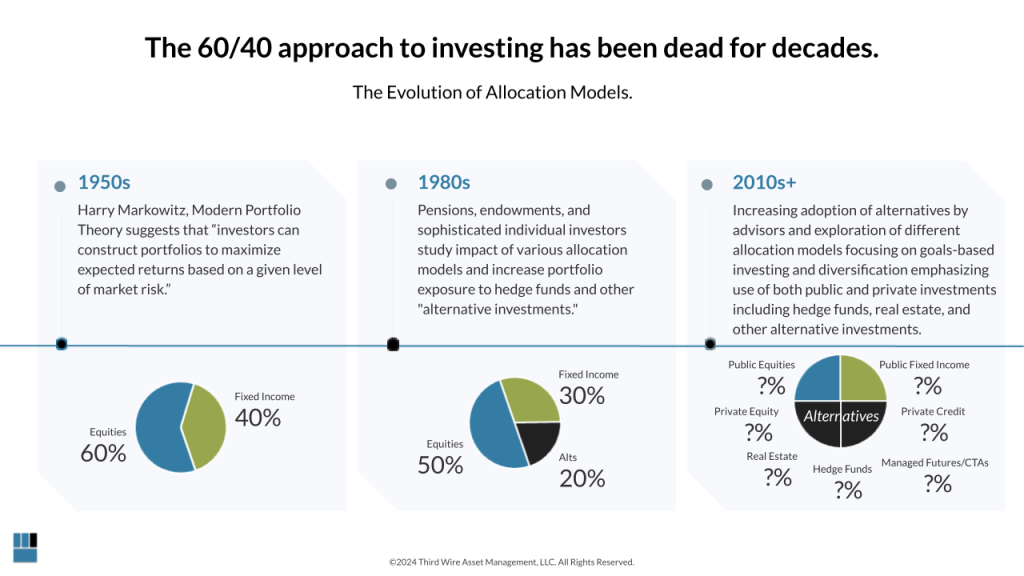

The 60/40 approach to investing has been dead for decades.

It’s been quite a while since the days when a simple 60/40 split between stocks and bonds was considered the cornerstone of portfolio construction.

Back in the 1950s, Harry Markowitz dropped the mic with Modern Portfolio Theory, emphasizing the benefits of diversification to optimize returns for a given level of risk. By the 1980s, sophisticated individual investors and a handful of pensions and endowments began exploring hedge funds and other “alternative investments” as a way to improve the diversification and performance of a traditional 60/40 portfolio.

Fast forward to today, and everyone’s talking about how your clients ‘need’ alternative investments.

This evolution raises critical questions: Where do alternatives truly fit in client portfolios, and how much exposure is appropriate? The answers aren’t as straightforward as many industry pundits would like you to believe.

You can’t just adopt a 50%, 30%, 20% model and call it a day or slam a 5% allocation to some private equity fund into all of your client’s portfolios. Or worse, fall into the trap of believing that the ‘institutional model’ of investing in alternatives is somehow appropriate for most individual investors, and so you load them up.

You know the old saying: If you give someone a hammer, every problem looks like a nail. Well, when you give a salesperson a 3.5% placement fee on your ‘evergreen’ fund, guess what they are likely to recommend? Whether it’s appropriate for an individual or not.

Moreover, while the potential benefits of alternatives are widely discussed, the associated complexities and challenges are often underplayed by those with a vested interest in selling alternative investments.

You know the old saying: If you give someone a hammer, every problem looks like a nail. Well, when you give a salesperson a 3.5% placement fee on your ‘evergreen’ fund, guess what they are likely to recommend? Whether it’s appropriate for an individual or not.

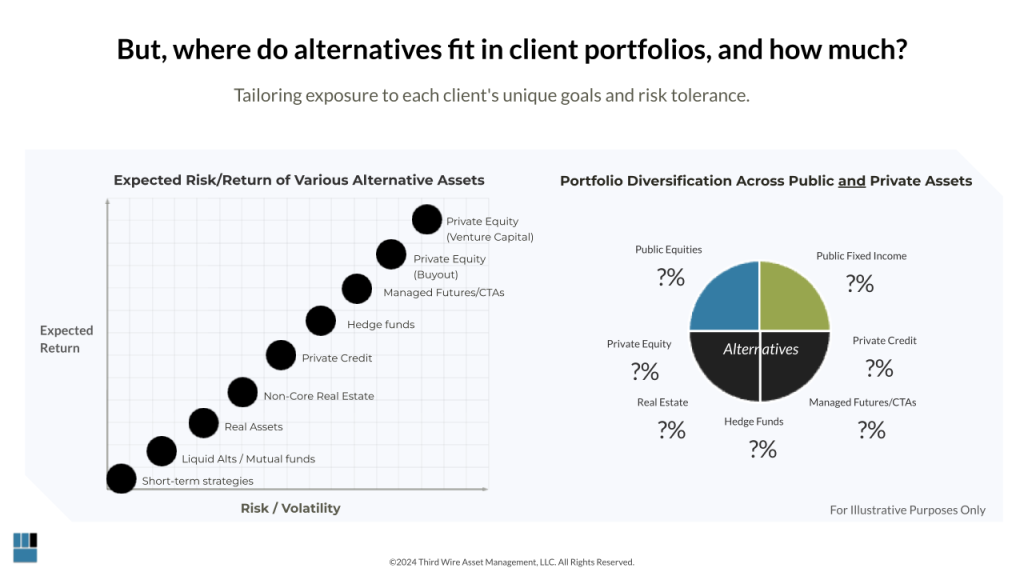

Where do alternatives fit in client portfolios, and how much?

The question of where alternatives fit in client portfolios is akin to asking how many spices to add to a dish—it depends entirely on the chef, the recipe, the diners, and the desired outcome. It’s fairly obvious that there isn’t a one-size-fits-all answer to alternatives.

A young tech entrepreneur will have a completely different risk profile than someone nearing retirement. A small business owner doesn’t have the same financial needs as a recently divorced individual, while a conservative retiree’s priorities differ vastly from those of a digital nomad. Each client presents unique circumstances that demand tailored investment strategies, especially when considering alternative assets.

Among other important factors, when considering alternatives, it’s essential to understand the risk/return characteristics of various assets and to tailor exposure to an individual’s unique goals, preferences, and risk tolerances accordingly.

It is also critical to assess how these offerings compare to traditional investments. For example, private equity offers high potential returns, but when you weigh this against the higher fees, lower liquidity, and heightened risk, it might not make sense for someone nearing retirement. Similarly, many hedge fund strategies show a low correlation to traditional markets, yet their performance varies drastically based on strategy and manager. You can’t just pick any old hedge fund.

We don’t view alternatives in isolation but as part of a holistic portfolio strategy. They need to complement, not dominate, a well-constructed portfolio.

We don’t view alternatives in isolation but as part of a holistic portfolio strategy. They need to complement, not dominate, a well-constructed portfolio.

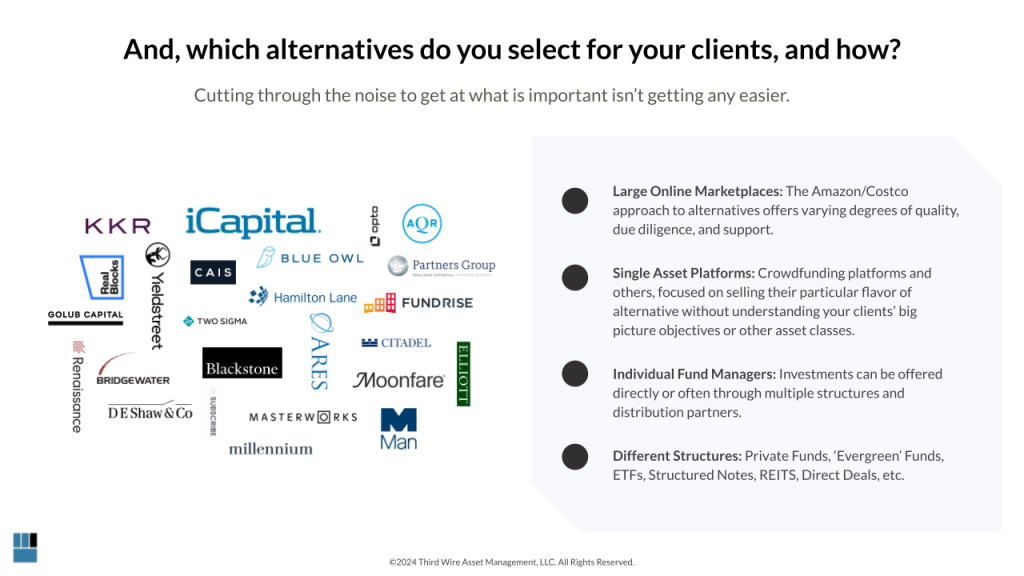

Which alternatives do you select for your clients, and how?

Access to alternative investments has never been better. But this also means the marketplace is crowded, and it’s getting more and more difficult to cut through all the marketing noise to get to what’s important.

- Large online marketplaces offer a Costco-like approach to alternatives—variety, but varying degrees of quality with regards to the investments they offer and the level of due diligence they provide.

- Single asset platforms focus on their particular flavor of alternative, often without considering an individual investor’s broader objectives.

- Individual fund managers may offer investments directly or through various structures and distribution partners, but like single-asset platforms, they tend to have a very narrow view of how their offerings might fit within an investor’s existing portfolio.

Then there’s the alphabet soup of investment structures: private funds, ‘evergreen’ funds, ETFs, structured notes, non-traded REITs, direct deals, and more. Each with its own set of pros, cons, fees, and fine print.

Cutting through the noise requires a disciplined approach focused on your clients’ specific needs, risk tolerances, and investment goals. It’s not about chasing the hottest new manager, strategy, fund, or following the herd—it’s about finding high-quality investments that are the right fit for each individual client.

Cutting through the noise requires a disciplined approach focused on your clients’ specific needs, risk tolerances, and investment goals. It’s not about chasing the hottest new manager, strategy, fund, or following the herd—it’s about finding high-quality investments that are the right fit for each individual client.

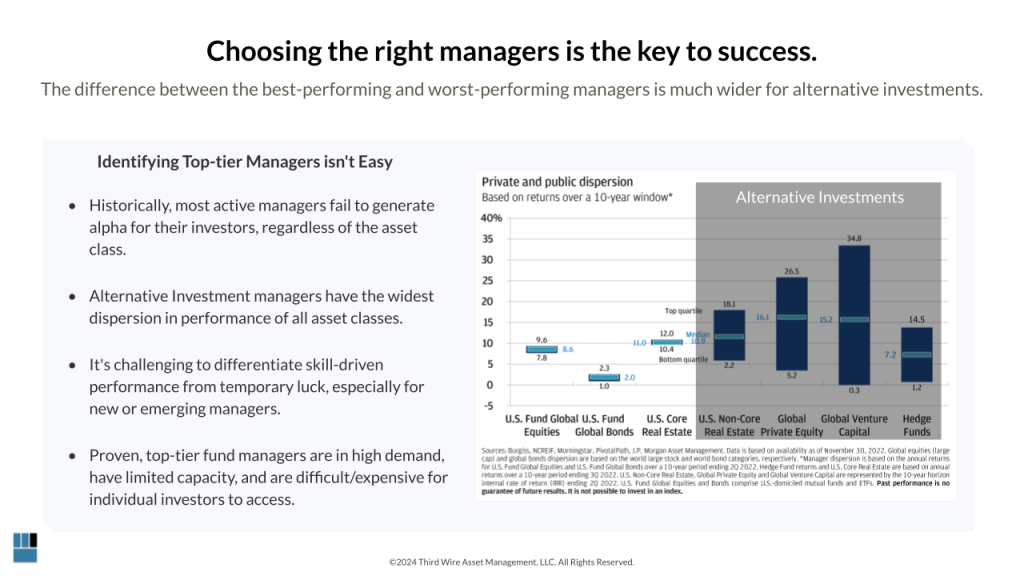

Choosing the right managers is the key to success.

We all know that when it comes to alternative investments, manager selection is the number one factor in future success. The dispersion between top and bottom-performing managers in alternatives is far wider than in traditional asset classes—and there are far fewer ‘top-tier’ and ‘institutional-quality’ managers than marketing materials would lead us to believe. You can’t all be in the Top Quartile; real math doesn’t work that way, people.

The uncomfortable truth? Historically, studies show that most active managers fail to outperform their benchmarks, regardless of the asset class. In alternatives, this is even more pronounced.

The uncomfortable truth? Historically, studies show that most active managers fail to outperform their benchmarks, regardless of the asset class. In alternatives, this is even more pronounced.

Identifying truly skilled managers is challenging. A few years of outperformance could be skill—or it could just be dumb luck. Being able to differentiate between the two requires experience, a rigorous due diligence process, and a healthy dose of skepticism.

Moreover, even if you identify a top-tier manager, accessing their fund can be another hurdle entirely. True top-tier managers aren’t always the big brand name ones, but they’re often in high demand from those in the know, have limited capacity, and may be difficult or expensive for individual investors to access.

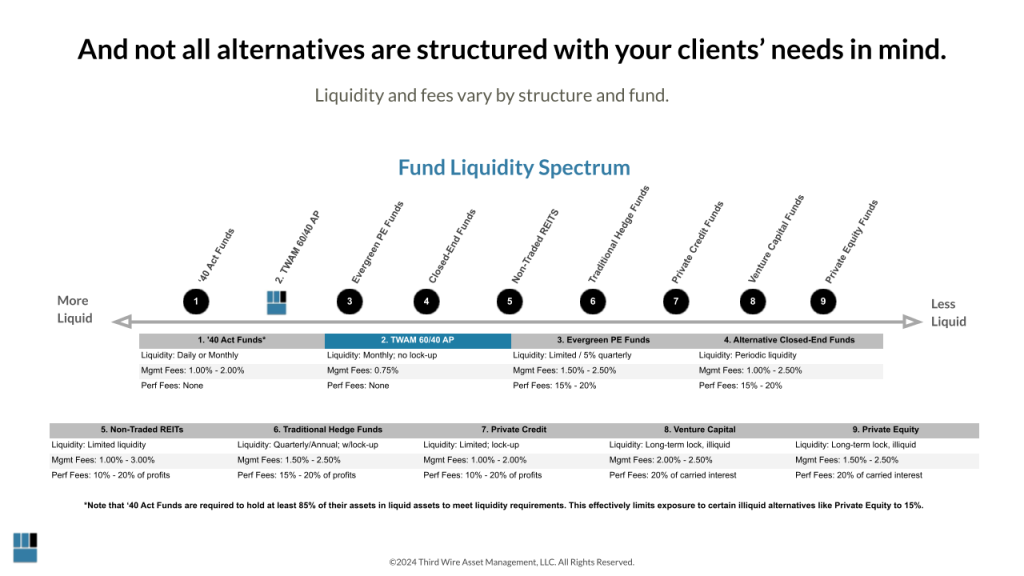

Not all alternatives are structured with your clients’ needs in mind

Here’s another unsurprising truth: many alternative investments are structured to benefit the managers more than the investors. Reading and understanding the fine print is crucial.

Liquidity is a key consideration. While a pension fund might be comfortable locking up capital for a decade, your average high-net-worth client probably isn’t. Yet many alternative investments come with long lock-up periods and limited liquidity options.

At the other end of the liquidity spectrum, there is increasing talk of making private capital investments available in ETF structures, with asset managers focused on ways to make private equity and private credit more liquid and accessible for advisors. While ETFs promise liquidity and accessibility, they would likely sacrifice many of the key benefits of private capital in exchange for convenience. Ultimately, these ‘lite’ versions may benefit asset managers looking to gather more assets from the private wealth channel, but they likely won’t deliver the full value that clients have been taught to expect from private markets investing.

And no conversation would be complete without addressing fees. High, unnecessary, and complex fees and terms widen the gap between gross performance and the net returns your clients will actually see.

And no conversation would be complete without addressing fees. High, unnecessary, and complex fees and terms widen the gap between gross performance and the net returns your clients will actually see.

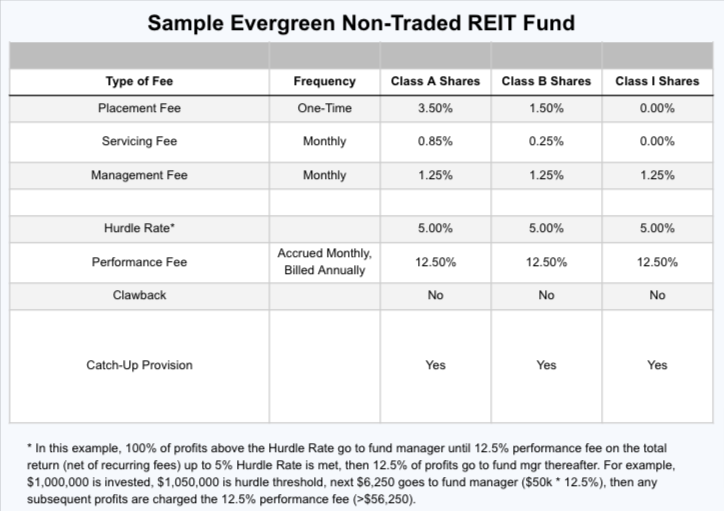

Let’s take a look. We broke down a sample fee structure from a typical Evergreen Non-Traded REIT Fund:

This fee structure isn’t just complex—it’s a potential wealth destroyer. Let’s dive in:

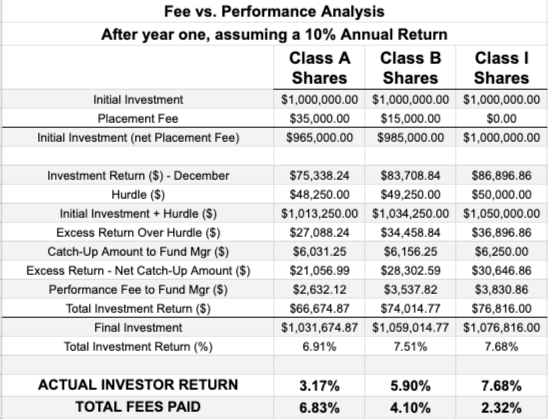

The examples provided are hypothetical and for illustrative purposes only. Actual returns and fees may vary.

For our analysis, we assumed a 10% annual return on a $1,000,000 investment.

After one year:

- Class A shares: 3.17% actual net investor return

- Class B shares: 5.90% actual net investor return

- Class I shares: 7.68% actual net investor return

In the Class A scenario, fees devour a staggering 6.83% of the return in year one. Even the “Institutional” Class I shares see 2.32% of returns consumed by fees.

For us, this fee structure raises several red flags:

- Placement fees: An immediate haircut to the investment, putting the investor behind from day one. For Class A, that’s a $35,000 hit before they even start.

- Servicing fees: These fees are a holdover from ancient times when technology wasn’t available to make reporting easy. Charging these types of fees today is, at best, egregious; at worst, in our view, it’s bordering on criminal.

- Opaque terms: Hurdles and catch-up provisions typically favor managers over investors. Read with care and caution.

- Compounding fees: The impact of fees compound over time, dramatically eroding long-term returns.

The industry likes to tout “Institutional models” without acknowledging that the “Institutional results” they showcase also benefit from “Institutional pricing.” For most investors, the reality will be far less rosy.

When it comes to fee structures, Performance Fees, Hurdle Rates, and Catch-Up Provisions are often hidden behind layers of complexity but can significantly impact investor returns.

When it comes to fee structures, Performance Fees, Hurdle Rates, and Catch-Up Provisions are often hidden behind layers of complexity but can significantly impact investor returns. Performance fees are meant to align the interests of the manager with the investor by rewarding outperformance. However, without clear hurdle rates—a minimum return the fund must achieve before collecting performance fees—the investor often bears the brunt of misaligned incentives. A well-structured hurdle rate should ensure that managers are only compensated for truly generating alpha, not for riding broad market gains.

Catch-up provisions further complicate this dynamic. Once a hurdle rate is achieved, the catch-up clause typically allows the manager to ‘catch up’ on performance fees they would have earned below the hurdle. While this seems fair on the surface, these provisions can be structured in ways that heavily favor the manager, further widening the gap between gross and net investor returns.

Understanding these provisions is crucial, as the cumulative effect of complex fee arrangements can eat away at returns, especially in funds that don’t consistently outperform.

Understanding these provisions is crucial, as the cumulative effect of complex fee arrangements can eat away at returns, especially in funds that don’t consistently outperform. Advisors need to ensure that the fee structures of their chosen funds are transparent and aligned with their clients’ best interests, not just designed to enrich the manager.

Every dollar paid in fees is a dollar not invested. Over time, the impact can be enormous. It’s crucial to scrutinize these fee structures and ensure your clients are getting real value for every dollar they are expected to pay in fees.

Conclusion

So, to sum things up? In our view, the “problem” with alternative investments isn’t that they’re becoming more accessible to more investors or that technology is helping to make the process of investing easier than it’s ever been—the “problem” is that the industry echo chamber is full of pundits and new entrants who look at your clients and just see dollar signs.

As a result, important aspects of what it takes to successfully add alternatives to the investment mix—including the fact that sometimes the most important decision might be to not invest in alternatives at all—are being glossed over in favor of sketchy marketing and advertising tactics meant to attract you and clients to their offerings at any cost.

To us, many of these firms seem far more focused on asset gathering than on helping investors meet their financial goals. As a result, important aspects of what it takes to successfully add alternatives to the investment mix—including the fact that sometimes the most important decision might be to not invest in alternatives at all—are being glossed over in favor of sketchy marketing and advertising tactics meant to attract you and clients to their offerings at any cost.

We believe the only way to move the industry forward and harness the potential benefits of alternatives while mitigating the risks for your clients is to continue to approach alternatives with a critical eye and a client-first mentality. Our hope is that the rest of the industry embraces this, particularly since they’re all so hell-bent on selling alternative investments to your clients.

Disclaimer:

This article is for informational and educational purposes only and should not be construed as providing tax or legal advice. It does not take into account the specific investment objectives, financial situation, or particular needs of any reader. Readers should consult with their own tax, legal, and financial advisors to determine the appropriateness of any investment strategy or approach mentioned herein. Investing involves risk, including the possible loss of principal.

PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.

Risks of Alternative Investments:

Alternative investments are complex and may not be suitable for all investors. They often involve a high degree of risk, including illiquidity, leverage, and the potential for significant volatility. Investors should carefully consider their individual investment objectives, risk tolerance, and financial circumstances before investing in alternatives. The use of leverage, restrictions on redemption, and the lack of transparency in alternative investments can increase risk.

Hypothetical Performance and Fee Examples:

The examples and scenarios discussed in this whitepaper, including fee structures and returns, are hypothetical and provided solely for illustrative purposes. They are not intended to project or predict actual investment results. Actual returns and costs may differ significantly.

Manager Selection and Due Diligence:

Successful manager selection and ongoing due diligence are critical to achieving potential benefits from alternative investments. However, the identification of a successful manager is difficult and subject to uncertainty. No guarantee can be made regarding the future performance of any manager or investment strategy.

Active vs. Passive Investment Strategies:

Statements made regarding the performance of actively managed investments relative to passive investments are based on historical data and broad market observations. These statements should not be taken as guarantees that future active management results will follow the same trend. Investors are encouraged to perform their own due diligence when choosing between active and passive strategies.

Institutional vs. Individual Investor Considerations:

Alternative investment strategies and pricing models designed for institutional investors may not be appropriate for individual investors. Investors should be aware that the terms and conditions, including fees, may differ between institutional and retail classes of investment products, potentially impacting net returns.

Consult A Financial Advisor:

Investors should consult with a qualified financial advisor before making any investment decisions, particularly regarding alternative investments. This whitepaper does not provide personalized financial, legal, or tax advice. All decisions regarding the appropriateness of an investment should be made in consultation with an independent advisor based on your individual financial circumstances and risk profile.