While Sharpe Ratio and standard deviation are cornerstone alternative investment risk metrics and provide valuable insights, other, more nuanced metrics are essential to deepening one’s understanding of an investment’s risk/return potential. In this article we discuss why the Sortino Ratio, maintaining a positive skew, and focusing on keeping a near-zero correlation to public markets are important considerations when selecting alternative investments for client portfolios.

Sortino Ratio vs. Sharpe Ratio

The Sharpe Ratio has long been a standard measure for assessing risk-adjusted returns. It helps investors understand how much excess return they are receiving for the extra volatility they expect for holding a riskier asset. A higher Sharpe Ratio indicates a more attractive risk-adjusted return. However, the Sortino Ratio offers a more refined analysis of volatility. Here’s why the Sortino Ratio is particularly valuable:

- Focus on Downside Risk: The Sortino Ratio differentiates harmful volatility from overall volatility, providing a clearer picture of the investment’s performance relative to its risk of loss. This is especially important in alternative investments, where the risk profiles can vary significantly from traditional assets.

- Enhanced Risk Management: By considering only the downside deviation, the Sortino Ratio helps investors identify investments that minimize the likelihood of significant losses, leading to potentially more robust risk management strategies.

- Improved Decision-Making: Investors can make more informed decisions by understanding the true risk of loss, rather than potentially being misled by overall volatility, which includes both upside and downside fluctuations.

Maintaining a Positive Skew

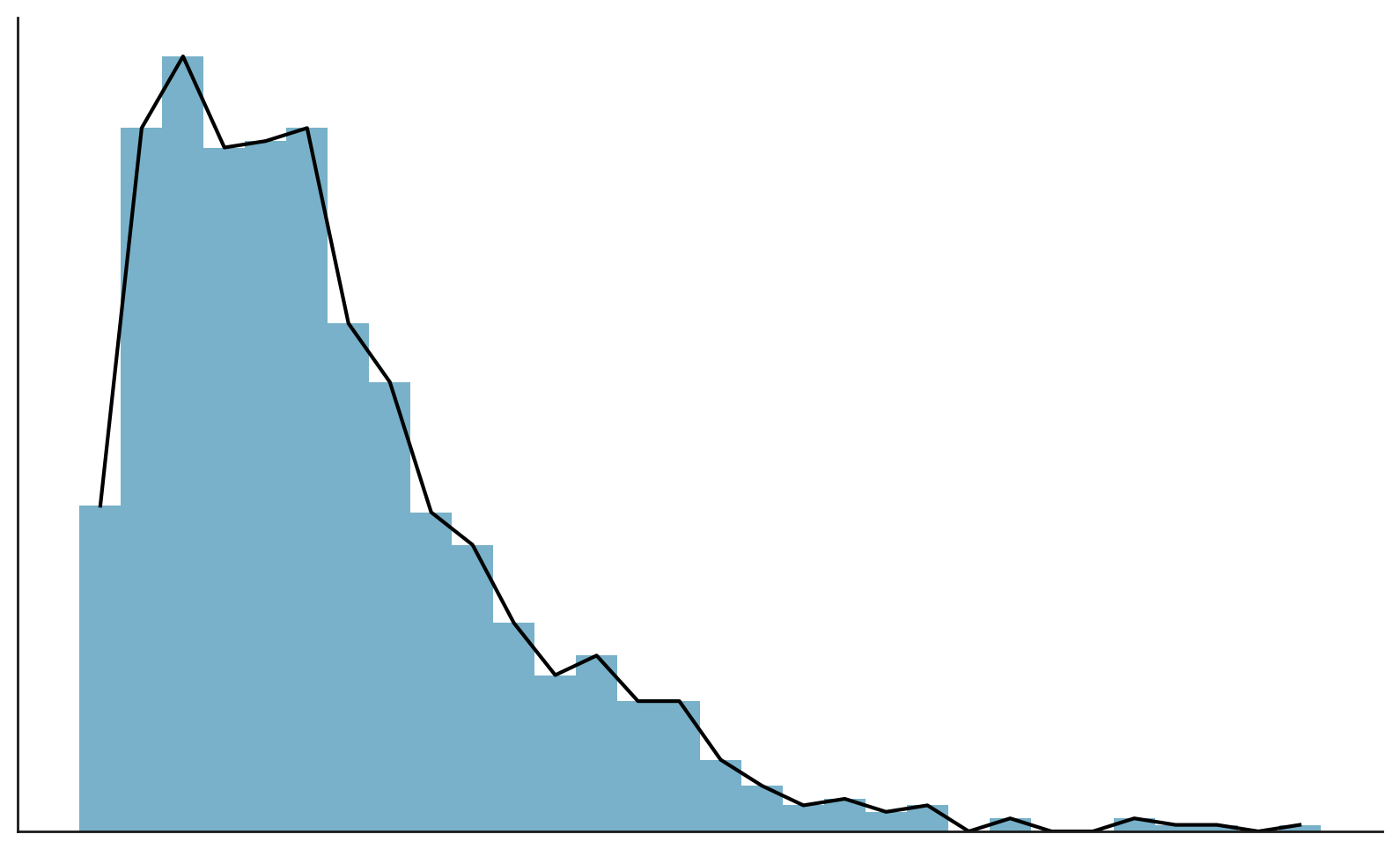

Skewness measures the asymmetry of return distributions. A positive skew is advantageous because it indicates frequent small losses and occasional large gains. Here’s why this is important:

- Enhancing Portfolio Performance: Investments with positive skew are more likely to deliver significant upside. These large gains can substantially boost a portfolio’s overall performance, compensating for the more frequent small losses.

- Behavioral Benefits: A positive skew suggests a lower probability of substantial negative returns, which can reduce the psychological stress associated with investment decisions.

- Mitigating Large Drawdowns: While small losses may be more frequent, the lack of large, catastrophic losses has the potential to protect the portfolio from severe drawdowns. This can be particularly beneficial during periods of market volatility.

Near-Zero Correlation to Public Markets

Correlation measures how investments move in relation to each other. A near-zero correlation to public markets means that the investment’s performance is independent of traditional equity and bond markets. Here’s why this is crucial:

- True Diversification: Alternative investments with near-zero correlation to public markets help to reduce the overall risk of the portfolio by spreading it across uncorrelated assets.

- Risk Mitigation: In times of market turmoil, investments with low correlation to public markets can act as a buffer, protecting the portfolio from significant downturns in traditional asset classes.

- Stability and Consistency: By including assets with near-zero correlation to public markets, investors can expect an overall reduction in portfolio volatility, as these investments are not influenced by the same factors driving the performance of traditional markets.

Conclusion

Focusing on the Sortino Ratio, maintaining a positive skew, and keeping a near-zero correlation to public markets are essential considerations for investors in alternative investments. These metrics provide a deeper understanding of risk and performance and help sophisticated investors build more resilient and diversified portfolios.

Contact us to learn how we can help you navigate the alternative investment industry successfully.

Disclaimer:

This article is for informational and educational purposes only and should not be construed as providing investment, tax, or legal advice. It does not take into account the specific investment objectives, financial situation, or particular needs of any reader. Readers should consult with their own tax, legal, and financial advisors to determine the appropriateness of any investment strategy or approach mentioned herein. Investing involves risk, including the possible loss of principal.

PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.